Well, I mean. As long as our GDP is high, who needs good schools and nice roads and an updated power grid and water pipes not made of lead. Gotta keep that GDP up there! Although, since costs are generally transferred down to the consumer, I imagine the only reason GDP would drop is cause some ceo or exec got a stick up their ass not being able to afford their 8th Ferrari. But that's just me being cynical.

Edit:

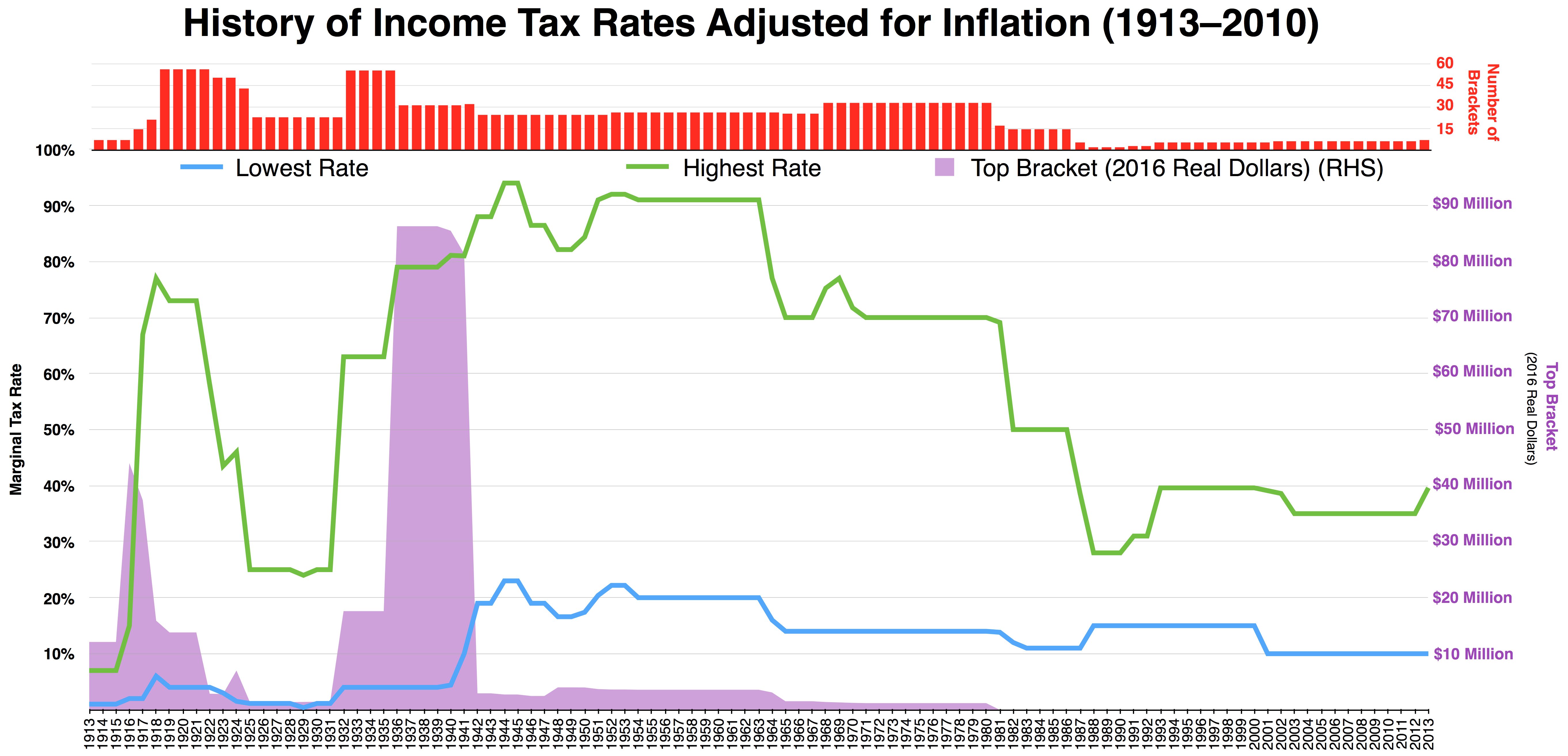

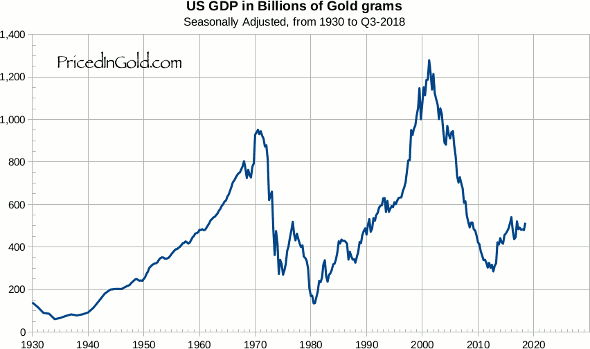

Btw. That GDP graph in "gold"... I got a similar graph to my own. It shows a far different GDP story. I wondered why you used one based on gold. I still do, but I ingaine it's because there is something there that makes it a better story for point. But, when you look at GDP, just as GDP and not GDP is gold value (does anyone still back their dollar in gold?) The story doesnt fit the narrative that lower taxes help GDP.

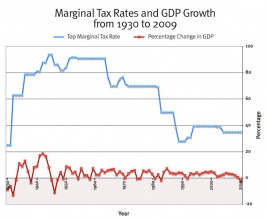

View attachment 774381

As we see, as taxes dropped, so did GDP. Of course lots of other factors no doubt had a hand in it all, wars and what not. But, one thing is pretty clear, lowering taxes sure doesn't look to raise GDP.

Edit: bah. It may have been to early for this post. I see that the graph is percentage of change, not where the GDP was at.

But, that said, there is still a disconnect here as the percentage of chance doesnt seem top line up with... you know what, hold. Im going to get an actual GDP chevy and not this in gold crap...

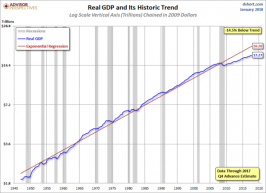

View attachment 774406

What I find interesting here is how GDP had not returned yp the trend line since the 2008 recession. Something not seen since the great depression.

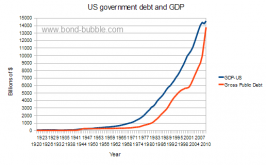

Even more interesting is the US deficit compared to GDP.

View attachment 774407

Most others show our debt climbing faster than the percentage of GDP. Now, I mean, I could be wrong, but that seems pretty unsustainable to me and it's quite clear to me as well who's policies had the greats effects one way or the other.